IBM’s stock climbed 45% in 2025 — just ahead of Nvidia’s 42% gain — as the tech giant quietly rebuilt its reputation as a quiet powerhouse in enterprise AI and quantum computing. The surge, confirmed by TECHi on November 16, 2025, isn’t just about numbers. It’s about strategy: IBM isn’t chasing flashy chatbots. It’s building precision tools that cut costs, boost efficiency, and solve real business problems — and customers are paying for it.

From Missed Forecasts to Market Leadership

June 30, 2025, was a day of contrasts for IBM. The company reported $16.98 billion in second-quarter revenue — a 7.7% jump from $15.77 billion a year earlier — beating Wall Street’s $16.59 billion forecast. But then came the twist: software operations revenue fell short. Investors panicked. The stock dropped 9% in after-hours trading. What most missed was the bigger picture. While software lagged, AI revenue soared 26% year-over-year to $9.5 billion in Q3, and the company saved $4.5 billion in annual productivity costs — more than double the $2.25 billion saved in 2023.

“It wasn’t a stumble,” said one analyst familiar with internal briefings. “It was a pivot. They’re letting the AI business carry the weight while the legacy units catch up.”

The Watsonx Strategy: Smaller, Sharper, Cheaper

While OpenAI and Google poured billions into massive, general-purpose models like ChatGPT and Gemini, IBM went the other way. Its Watsonx platform — particularly Watsonx.ai — focuses on fine-tuned, domain-specific AI. Think retail inventory forecasting that learns from a single chain’s sales patterns, or healthcare claims processing that adapts to Medicare rules in real time. These aren’t one-size-fits-all tools. They’re surgical instruments.

“People said, ‘Step one: we’re going to use LLMs. Step two: What should we use them for?’” warned Marina Danilevsky, Senior Research Scientist in Language Technologies at IBM. “We skipped step two. We built step one to do exactly what our clients need — nothing more, nothing less.”

The result? Retail and consumer goods firms plan to spend an average of 3.32% of revenue on AI by 2025 — about $33.2 million annually for a $1 billion company. And 81% of Chief Data Officers say accelerating AI is their top priority. IBM’s approach fits like a glove.

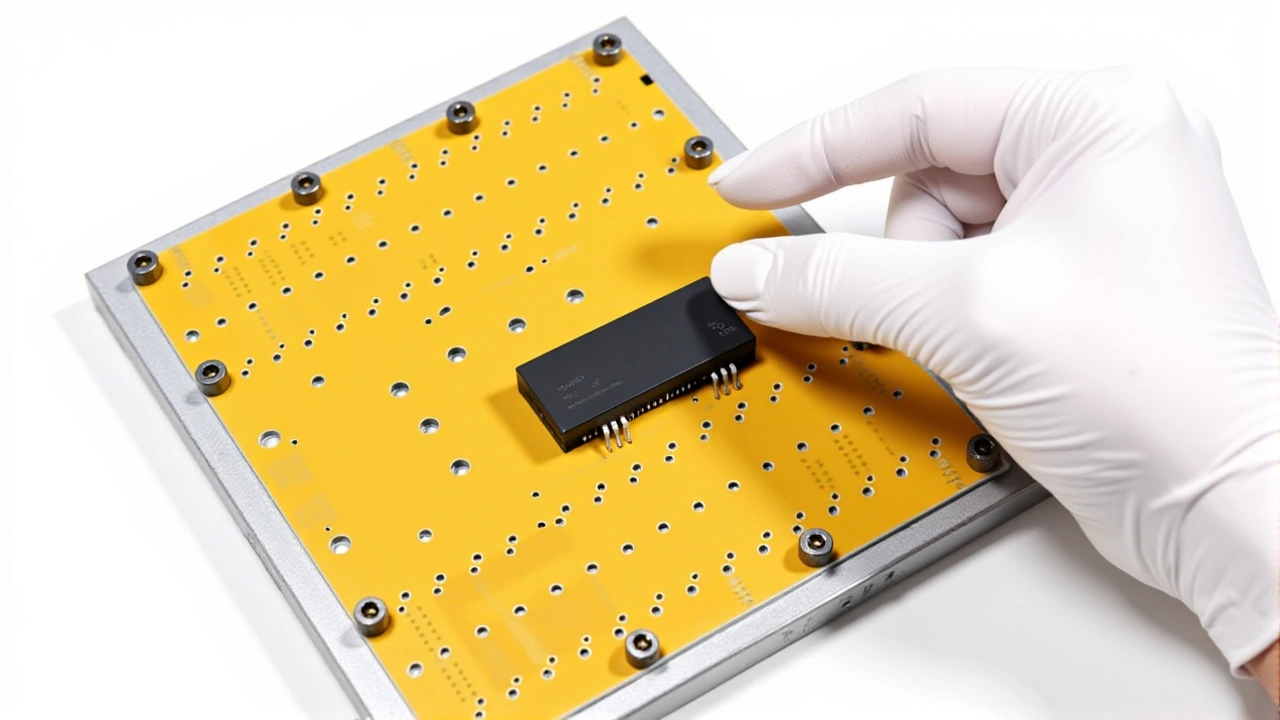

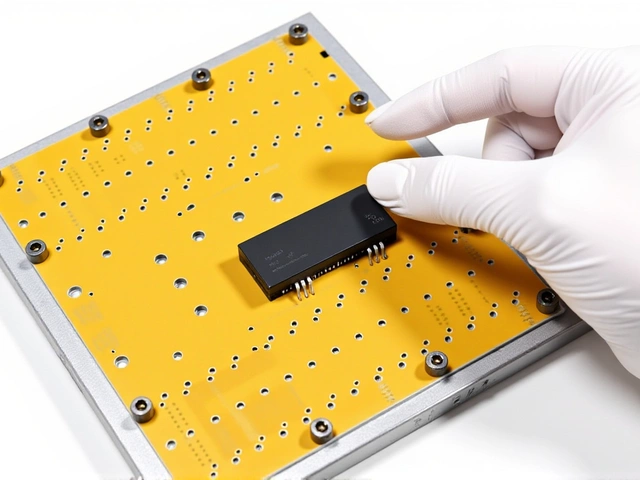

Quantum Computing: The Long Game

While AI is driving today’s profits, IBM’s real moonshot is IBM Quantum Starling. Scheduled to go live in 2029, this machine promises to perform 20,000 times more operations than today’s quantum systems. That’s not hype — it’s physics. The goal? Crack problems in cryptography, drug discovery, and supply chain optimization that classical computers can’t touch.

“We’re not building a faster computer,” said an IBM Quantum executive in a private briefing. “We’re building a new kind of problem-solver. The world won’t notice until it suddenly can’t be solved any other way.”

That’s why R&D spending jumped 14% in Q2 2025 to $2.1 billion — 12.4% of revenue. It’s the highest percentage in a decade. Investors might grumble about margins, but they’re betting on the future.

Who’s Winning and Why

Nvidia still dominates the AI chip market. But IBM isn’t trying to replace it. It’s using chips to build better software. Where Nvidia sells hardware to everyone, IBM sells tailored solutions to Fortune 500s, banks, and government agencies — industries that care more about compliance, security, and integration than raw speed.

Its hybrid cloud platform, powered by Red Hat OpenShift, lets clients run AI workloads on-premises or in the cloud — critical for healthcare and financial services under strict regulations. That’s not sexy. But it’s sticky. Once a bank integrates IBM’s AI tools into its core systems, switching costs are astronomical.

And the numbers back it up: IBM now serves over 4,000 government and corporate clients across 175 countries. Its gross margins are expanding. Its 2025 revenue projection has been revised upward — exceeding 5% growth. Profitability is returning.

What’s Next: Retail, Regulation, and Real-World Impact

At the National Retail Federation’s NRF 2025 event in January, IBM will showcase AI-driven personalization at Booth #4639 — from dynamic pricing to sustainable supply chain routing. Retailers aren’t just using AI to recommend products. They’re using it to reduce waste, cut delivery times, and predict stockouts before they happen.

Meanwhile, regulatory pressure is rising. The EU’s AI Act and U.S. executive orders on algorithmic accountability mean companies can’t just deploy AI and hope for the best. IBM’s audit trails, explainable AI models, and compliance frameworks are becoming selling points — not afterthoughts.

“The AI gold rush is over,” said a former Microsoft AI executive now advising clients. “What’s left is the mining equipment. And IBM just built the best pickaxe.”

Frequently Asked Questions

Why did IBM’s stock drop 9% after strong earnings?

Despite overall revenue beating forecasts, IBM’s software operations segment underperformed in Q2 2025, triggering investor concerns about legacy business health. But the drop was temporary — the real story was AI revenue growing 26% to $9.5 billion and $4.5 billion in annual productivity savings, which quickly overshadowed the software shortfall. Market sentiment shifted within days as analysts recognized the strategic pivot.

How is IBM’s AI different from ChatGPT or Google Gemini?

Unlike broad, general-purpose models, IBM’s Watsonx.ai builds small, precise AI tools trained on industry-specific data — like retail inventory systems or insurance claims workflows. These models cost less to run, require less data, and deliver higher ROI for enterprise clients. IBM avoids the “one model fits all” trap, focusing instead on integration, compliance, and measurable efficiency gains — making its solutions more practical than flashy.

What role does IBM Quantum Starling play in IBM’s future?

IBM Quantum Starling, set to launch in 2029, isn’t meant to replace classical computers. It’s designed to solve problems too complex for today’s systems — like simulating new molecules for drug development or breaking advanced encryption. While not a revenue driver yet, it positions IBM as the long-term leader in next-gen computing, attracting government contracts and R&D partnerships that reinforce its enterprise credibility.

Why are Chief Data Officers prioritizing IBM’s AI tools?

81% of Chief Data Officers say accelerating AI is their top investment priority, and IBM delivers what they need: security, compliance, and measurable ROI. Unlike open-source or cloud-native models, IBM’s tools integrate with existing systems like Red Hat OpenShift and offer audit trails for regulators. In industries like banking and healthcare, that’s worth more than raw performance — it’s a requirement.

Is IBM’s 45% stock surge sustainable?

Sustainability hinges on execution. IBM’s AI revenue growth and cost savings are real, but the company must keep delivering on quantum milestones and enterprise adoption. Its hybrid cloud strategy and focus on regulated industries reduce volatility compared to consumer-facing tech firms. With 2025 revenue projections revised upward and gross margins improving, the trend looks durable — especially if Quantum Starling gains traction with early adopters by 2027.

How does IBM compare to Nvidia in the AI race?

Nvidia dominates the hardware layer — selling the chips that power AI. IBM dominates the software and integration layer — building tailored AI solutions that run on those chips. Nvidia’s growth comes from scale. IBM’s comes from depth. One sells the engine. The other builds the entire car — and makes sure it meets safety standards. Both are winning, but in different lanes.

Write a comment